Attract & Retain Top Talent Today with Benefits That Last a Lifetime

As a business owner or HR director, you know that attracting and retaining quality employees is key to success. At MWE Partnership, we offer an innovative way to differentiate your benefits package without adding costs — permanent life insurance with a built-in long-term care rider.

This valuable coverage provides:

- Guaranteed life insurance protection for you, your employees, and your families

- Cash value that grows tax-deferred so there is money available when you need it

- Long-term care coverage that helps pay for skilled nursing care at home, in an assisted living facility, or nursing home

- No out-of-pocket premium cost to you or your business — employees contribute through convenient payroll deductions

- A premium solution for small businesses and large companies alike — available to those employing 5-500 people

- No underwriting questions — get started in 15 minutes

Schedule a Free 15 Minute Call

The Long-Term Care Coverage is What Makes This Policy Powerful

As the average lifespan increases, long-term care services become more necessary. However, the cost of care associated with aging or chronic illness can quickly deplete your life savings. In the United States, long-term care expenses can run between $35,000 and $108,000 a year.

See State-by-State Average Cost Comparison

With long-term care benefits, the financial burden of paying for long-term care is lifted — no matter when you need it. In fact, 40% of people currently receiving long-term care are between 18-65 years old — well before retirement age.

Key benefits include:

- Reduced Out-of-Pocket Costs: Long-term care like home health aides, assisted living facilities, or nursing home care is extremely expensive, costing $100,000 or more per year. MWE can help ensure you and your employees don’t bear the full financial burden.

- Coverage Earlier in Life: Without coverage, most people rely on paying out-of-pocket until they spend down assets and qualify for Medicaid. MWE provides an option to access affordable quality care at any age.

- Prevents Premature Asset Depletion: Needing care before retirement age could severely impact assets employees are counting on for retirement. MWE can set it up so the insurance payout prevents draining those retirement funds too early.

- Adapts as Care Evolves: As care needs change, MWE’s permanent life with long-term care policy provides coverage for care at home or in facilities like assisted living and nursing homes as needs change over time.

- Spouse & Family Relief: Having coverage relieves financial stress for spouses and immediate family members who might otherwise need to pay for expensive care out-of-pocket. Count on MWE to take care of your team and their family.

Best of all, permanent life insurance with LTC has no out-of-pocket premium costs for your business, bringing you and your CFO peace of mind. Employees pay affordable, age-based premiums themselves through convenient payroll deductions. Coverage amounts from $50,000 up to $500,000 are available.

Schedule a Free 15 Minute Call

A Big Benefit for Small Businesses

Our permanent life with long-term care policy provides valuable benefits and helps you attract top talent — even for small businesses with as few as five (5) employees. It shows you invest in the financial well-being of your staff for years to come. As an added incentive, as a business owner, you get to have this policy for yourself, too.

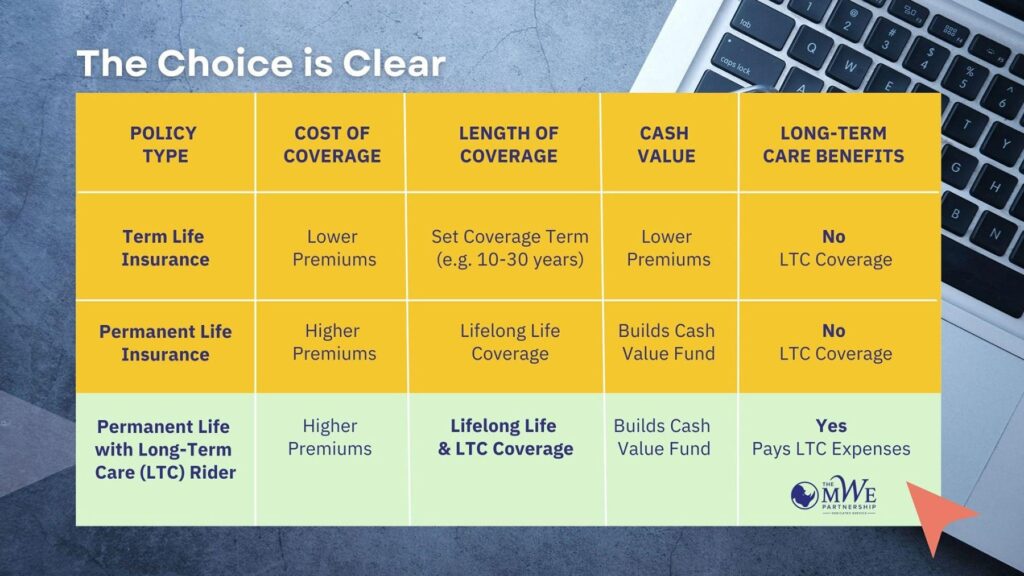

Compare Coverage Options

At MWE, we understand that choosing between the different types of life insurance can be confusing. The table below breaks down the differences. The choice depends on budget and priorities — term life works well for temporary needs, while permanent policies offer lasting coverage and more perks. Adding the LTC rider gives policyholders the ability to use the death benefit even while living and if long-term care is needed.

Get Started with a 15-Minute Call

Simply schedule a quick 15-minute call with MWE to learn more and get pre-approved. No extensive health questionnaires are required. We’ll provide a full overview of the policy details and explain how we can customize a package perfect for your team.

Why Work with MWE for Permanent Life with LTC Coverage?

At MWE, we specialize in permanent life insurance with access to unique underwriting offers that can only be obtained through a consistent track record of service with our partner carriers for over 20 years. As a result, employees and their immediate family members can qualify for permanent life with long-term care insurance policies without answering a single underwriting question.

Not having to answer underwriting questions to qualify for coverage leads to greater financial security and these additional benefits:

- Speed and Convenience: The application process can typically be completed very quickly, often in a matter of days, since no health assessment is required upfront. This is much faster than traditional policies.

- No Health History Issues: Applicants don’t have to worry about being denied coverage or having limited benefits if they have any pre-existing conditions or health issues. The lack of underwriting provides more inclusive access.

- Coverage for All Employees: If employer-provided as a work benefit, eliminating underwriting means policies can be offered to all employees regardless of age or health status. No one has to be left out of this valuable protection.

- Lock in Young, Healthy Rates: By enrolling while young and healthy, employees and employers can lock in very affordable premium rates for the long run without having to document their current health status. Rates stay based on entry age.

Don’t Wait. Schedule Your Free 15-Minute Call Today

Contact MWE at 410-394-9617 or [email protected] for a free consultation. We look forward to helping you take your benefits package and your team to the next level while staying within your budget.